2018 Mileage Log for Sole Proprietors

Sole proprietors who use their personal vehicles for business purposes have one way to claim their mileage as a business expense – a mileage log. And the beginning of a new year is the perfect time to start your first mileage log, or to start a new log for the new year.

In Canada, Form T2125 Statement of Business or Professional Activities is used to help calculate self-employed business and professional income. Part 17 covers motor vehicle expenses, and the first two fields required are Kilometres you drove in the fiscal period that was part of earning business income and Total kilometres you drove in the fiscal period. Where do these numbers come from? From your mileage log.

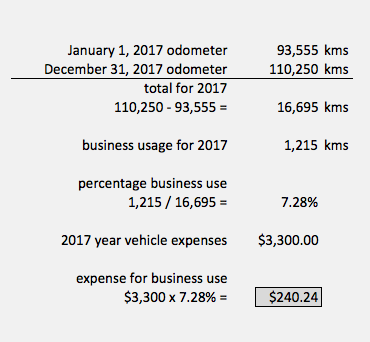

You need to start with your vehicle's odometer reading on January 1, or the first day it was used for business purposes if that isn't on January 1. At the end of the year, the odometer reading also needs to be taken so that the percentage of business use can be calculated.

For example, business owner Anna started 2017 with a mileage log on January 1 and an odometer reading of 93,555 kms. Throughout the year, Anna kept track of her business usage of the vehicle, and on December 21, 2017 the total usage for business purposes was 1,215 kms. Her odometer reading on December 31 was 110,250. The total mileage for the vehicle was 110,250 - 93,555 or 16,695. The percentage of business usage was 1,215/16,695 or 7.28%.

Anna had kept all of her applicable vehicle expenses (including every gas receipt for the year) and the total was $3,300 for her car, which was owned outright. 7.28% of the total expense of $3,300 was $240.24, and would go on line 12 of Part 17 of Form T2125.

It is a lot of work to gather the backup for a $240.24 business expense, but it's the only option for sole proprietors who want to claim the business use of their personal vehicle.

If you change vehicles during the year, just note the ending odometer reading of the old vehicle and the starting odometer reading of the new vehicle, and the total kms for both vehicles added together would be used.

Subscribe to Clearview's mailing list to receive future blogs on topics of interest to small business owners. Or suggest a topic you'd like to see covered using the Ask Us! button.

This blog is intended for information purposes only, and is not meant to replace the services of a bookkeeper or an accountant.

Now available on Pinterest

Click here to go to this infographic.